how much taxes deducted from paycheck nc suburban

Supports hourly salary income and multiple pay frequencies. Effective January 1 2020 a payer must deduct and withhold North Carolina income tax from the non-wage compensation paid to a payee.

North Carolina Hourly Paycheck Calculator Gusto

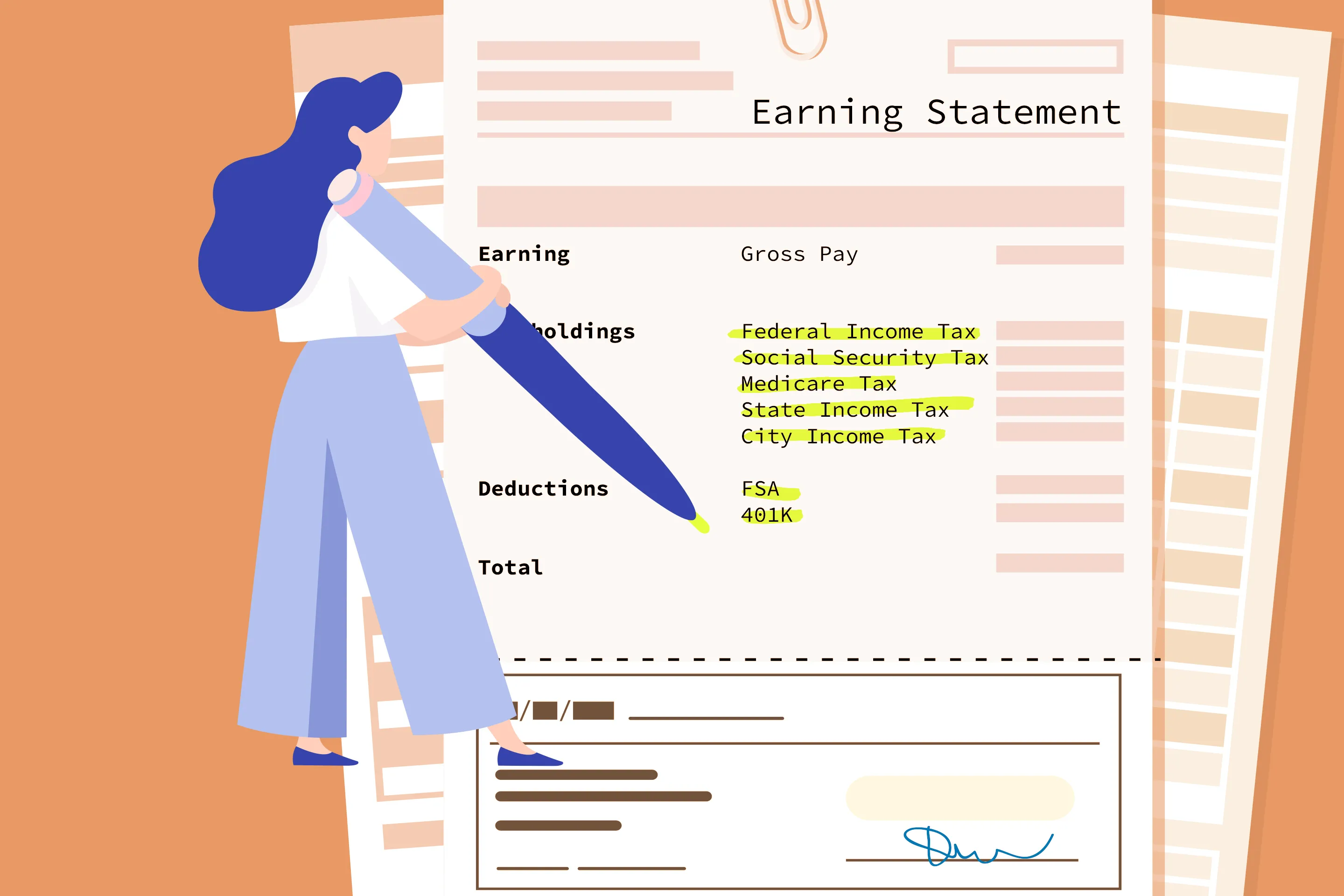

Payroll tax withholding is another important.

. For Tax Years 2017 and 2018 the North Carolina individual income tax rate is 5499. Besides that there is no other special tax unique to North Carolina. The currently applicable FICA tax rates At the moment the tax rate for social security is set at 62 percent for employers and 62.

The income tax is a flat rate of 499. For example in the tax year 2020. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

Arkansas residents can tweak their paychecks in a few ways. This tax is paid at the rate of 6 on the first 7000 earned by each employee in a. These are contributions that you make before any taxes are withheld from your paycheck.

Thursday October 6 2022 Edit. You can deduct the most common personal deductions to lower your taxable. North Carolinas flat tax rate for 2018 is 549 percent.

Any wages above 147000 are exempt from. Calculates Federal FICA Medicare and. Thats because the IRS imposes a 124 Social Security tax and a 29 Medicare tax on net earnings.

Also What is the percentage of federal taxes taken out of a paycheck 2021. Therefore it will deduct only the state income tax from your paycheck. North Carolina income tax rate.

The amount of taxes to be withheld is. The amount of taxes to be. Subtract and match 62 of each employees taxable wages until they have earned 147000 2022 tax year for that calendar year.

In North Carolina The state income tax in North Carolina is 525. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. Depending on your filing status you pay federal income tax at a rate of 22 on your taxable income.

Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. IRS requires the employer to pay another tax known as The Federal Unemployment Tax Act Tax. Use ADPs North Carolina Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

All you need to do for this is fill in. What percentage is deducted from paycheck. You must match the amount taken out of each employees paycheck plus an additional 14 times the amount.

If your taxable income is in the first 45142 of what you earn your tax rate will be 05. This free easy to use payroll calculator will calculate your take home pay. The IRS charges 15 of the amount up to 90287 for a portion of taxable income over.

One way to do this is to ask your employer to withhold a certain amount from each paycheck. Census Bureau Number of cities that have local income taxes. How Your North Carolina Paycheck Works.

In North Carolina The state income tax. How much do you make after taxes in North Carolina. For example in the tax year 2020.

Just enter the wages tax withholdings and other information required. North Carolina Paycheck Calculator Smartasset Urbanicity Realtor Com Economic Research Urbanicity Realtor Com Economic Research Urbanicity Realtor Com Economic. For Tax Years 2019 and 2020 the North Carolina individual income tax rate is 525 00525.

The employer withholds this tax from the employees paycheck.

Free North Carolina Payroll Calculator 2022 Nc Tax Rates Onpay

Paycheck Calculator North Carolina Nc Hourly Salary

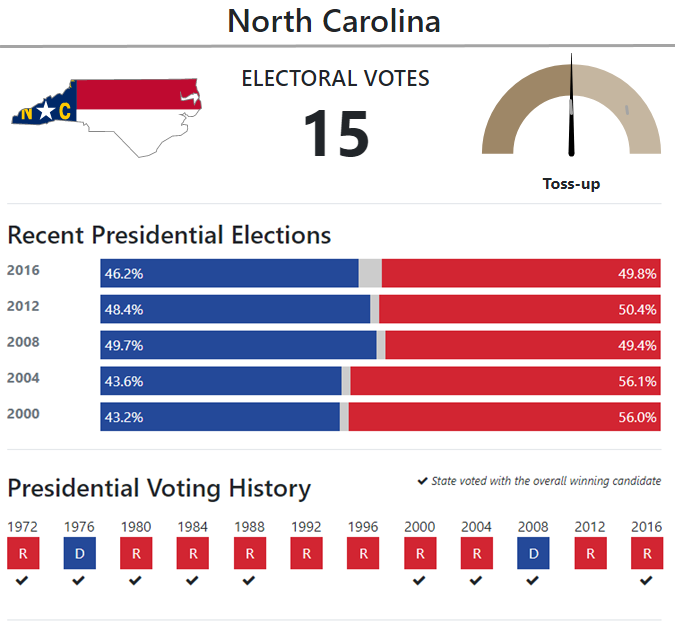

The Road To 270 North Carolina 270towin

Minimum Wage Map Shows Which States You Can T Afford

Who Really Pays Economic Opportunity Institute Economic Opportunity Institute

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

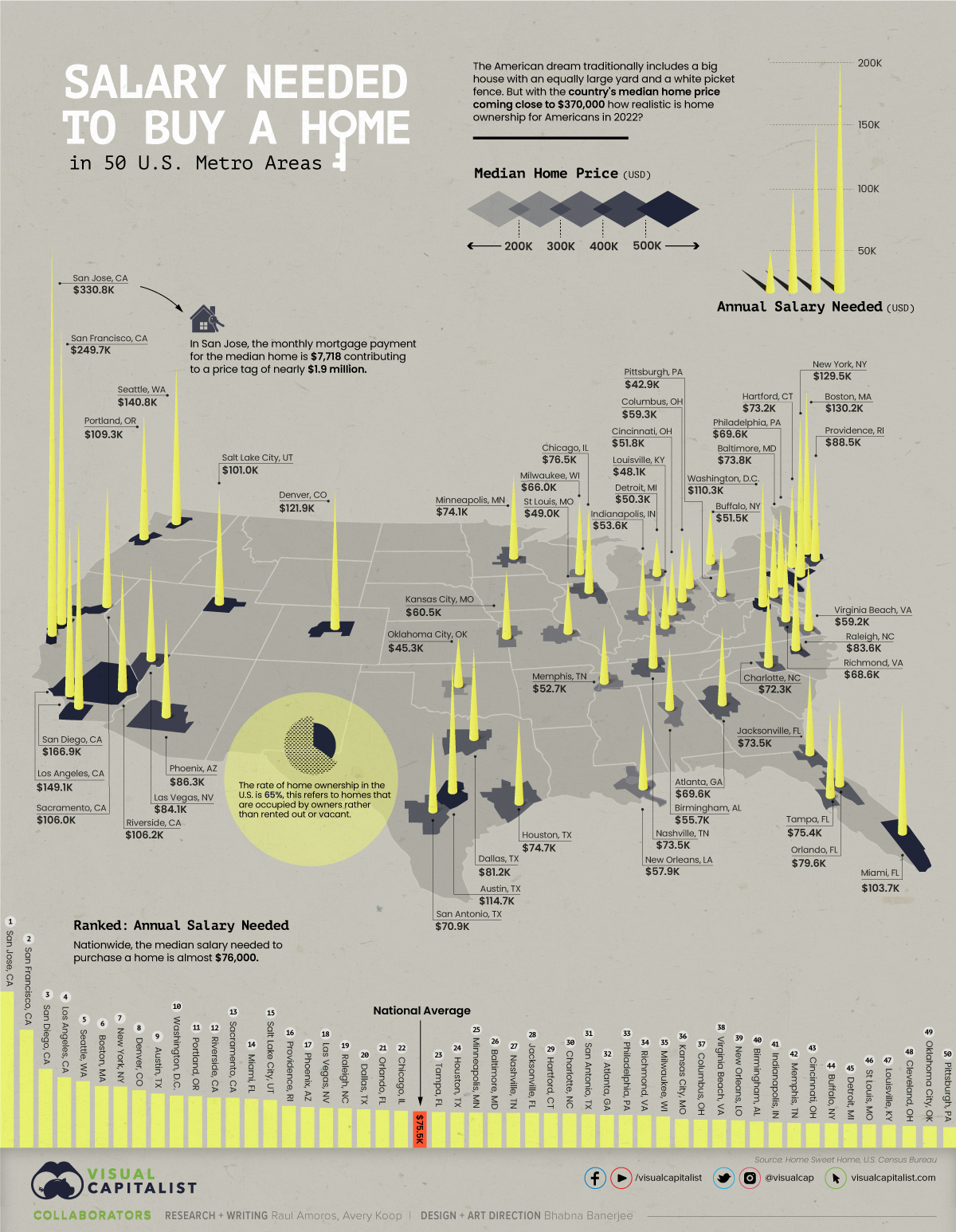

Mapped The Salary You Need To Buy A Home In 50 U S Cities

America S History 8th Edition Ppt Download

Wisconsin Paycheck Calculator Adp

Bluerock Residential Growth Reit Inc General Corporate Statement Form8 Benzinga

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Urbanicity Realtor Com Economic Research

How To Calculate Payroll And Income Tax Deductions Peo Human Resources Blog

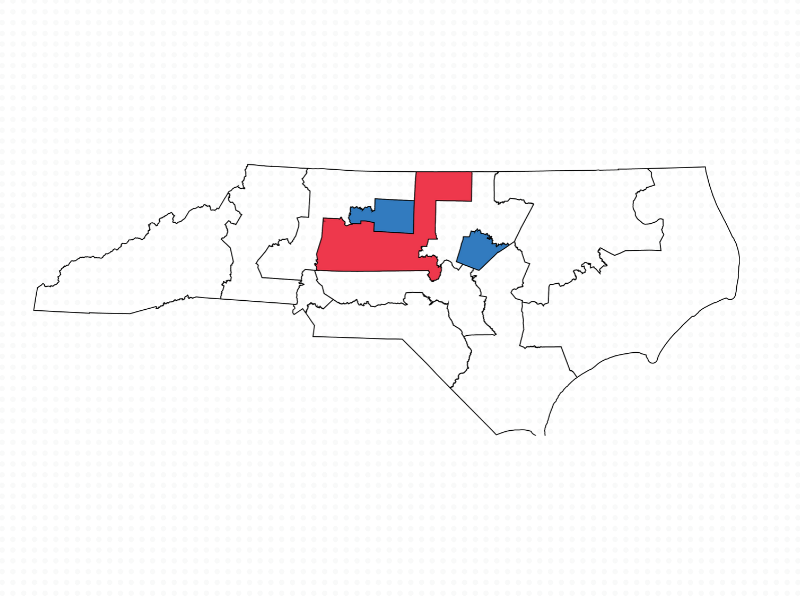

Rating Changes Final North Carolina Map Boosts House Democrats Cook Political Report

Federal Income Tax 61 Of Households Paid No Taxes For 2020 Money

5 Tricks For Getting A Bigger Paycheck In 2021 Money